Who needs a TSP-76 form?

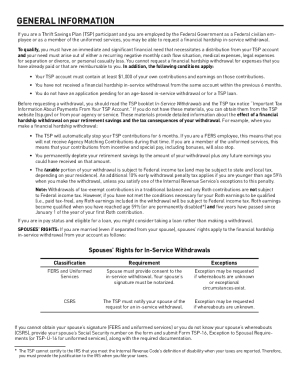

All participants in the Thrift Saving Plan can request a financial hardship in-service withdrawal. If the individual has serious financial problems, he can withdraw a certain sum of money from his retirement account before he retires.

What is the form TSP-76 for?

This form is a request for financial help. A person who bears medical expenses, legal expenses for a divorce, or others can fill out this form to receive money from his or her retirement account. To start this process, the applicant should have at least $1,000 in his account. The TSP hardship withdrawal request can be sent once every six months. The applicant should keep in mind that submitting this form will affect retirement savings and taxes. It’s always better to ask for a loan than make a hardship withdrawal request.

Is the TSP-76 form accompanied by other forms?

If there is a need, the fillable TSP-76 form is accompanied by the form TSP-16 (Exception to Spousal Requirements).

When is the TSP-76 form due?

The applicant should fill out this form when it’s needed. It should not, however, be submitted more than once in six months.

How to fill out the hardship withdrawal request form?

The form has two pages and detailed instructions for each page. While completing the form, the applicant should include the following information:

-

Type of the account for withdrawal (civilian or uniformed services)

-

Name, TSP account number, date of birth, phone number

-

Information about the spouse (name, signature, date of signing, address) certified by the notary

-

The requested amount of money ($1,000 or more)

-

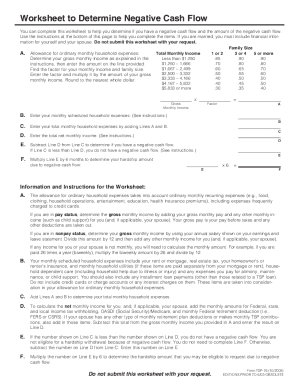

Reasons for the request (negative monthly cash flow, personal casualty loss, medical expenses, legal fees)

-

Information about direct deposit

The form must be certified and notarized.

Where do I send the TSP-76 form?

The completed form should be sent to Thrift Savings Plan, Birmingham, AL 35 238